5 Easy Facts About Paul B Insurance Explained

Wiki Article

Some Known Factual Statements About Paul B Insurance

Table of ContentsEverything about Paul B InsuranceExamine This Report about Paul B InsuranceThe Main Principles Of Paul B Insurance Paul B Insurance Fundamentals Explained

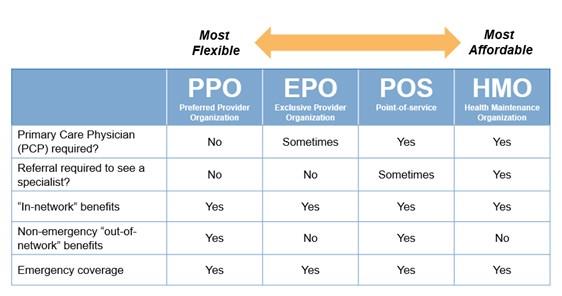

If there is treatment you anticipate to need in the future that you haven't needed in the past (e. g., you're anticipating your initial youngster), you may be able to obtain an idea of the prospective prices by consulting your present insurance company's price estimator. Insurance firms typically develop these kind of devices to help their participants store for medical treatment.Equipped with info about existing and also future clinical requirements, you'll be far better able to examine your plan choices by applying your estimated costs to the strategies you are thinking about. All the health insurance prepares talked about over consist of a network of medical professionals and also health centers, but the dimension and scope of those networks can differ, even for plans of the same kind.

That's due to the fact that the medical insurance firm has an agreement for reduced prices with those certain service providers. As gone over formerly, some plans will certainly enable you to make use of out-of-network companies, however it will certainly cost you much more out of your very own pocket. Other plans will not cover any kind of care received beyond the network.

It could be a fundamental part of your decision. Below's a summary of the tips supplied above: See if you're qualified for a subsidy, so you can determine what your premiums will certainly be and also so you'll understand where you require to shop. Testimonial your existing strategy to recognize just how it does or does not meet your demands, and maintain this in mind as you assess your options.

The Of Paul B Insurance

Get claims and therapy expense data from your existing insurance provider's member portal to understand past as well as potential future clinical expenses. Utilize this details to estimate out-of-pocket prices for the other strategies you're thinking about. Study the networks for the strategies you are taking into consideration to see if your favored medical professionals and healthcare facilities are included.An FFS choice that allows you to see clinical suppliers that decrease their charges to the strategy; you pay less cash out-of-pocket when you make use of a PPO carrier. When you visit a PPO you typically will not have to submit claims or paperwork. Nevertheless, going to a PPO visit this site hospital does not guarantee PPO benefits for all services obtained within that hospital.

Generally enrolling in a FFS plan does not assure that a PPO will be offered in your location. PPOs have a stronger visibility in some areas than others, and in areas where there are regional PPOs, the non-PPO benefit is get more the conventional advantage.

Your PCP gives your general healthcare. In lots of HMOs, you should get authorization or a "reference" from your PCP to see various other providers. The referral is a referral by your doctor for you to be examined and/or dealt with by a different physician or doctor. The referral guarantees that you see the ideal supplier for the care most suitable to your problem.

The Of Paul B Insurance

A Health Savings Account enables people to spend for existing wellness costs and conserve for future certified clinical costs on a pretax basis. Funds deposited into an HSA are not exhausted, the balance in the HSA grows tax-free, which amount is readily available on a tax-free basis to pay medical prices.

HSAs go through a variety of guidelines and also constraints established by the Department of Treasury. Check out Division of Treasury Source Center for additional information.

They get to know you and also your wellness demands and can help collaborate all your care. If you require to see a specialist, you are called for to obtain a reference.

Not known Facts About Paul B Insurance

If you presently have medical insurance from visit the website Friday Health Plans, your protection will end on August 31, 2023. To stay covered for the remainder of 2023, you should register in a brand-new plan. Begin

Employees have an annual insurance deductible they have to meet prior to the medical insurance business begins covering their medical expenses. They might additionally have a copayment for particular solutions or a co-insurance where they're responsible for a portion of the total costs. Providers outside of the network generally cause greater out-of-pocket prices.

Report this wiki page